When it comes to car insurance in New Zealand, many Kiwi drivers assume the cheapest policy is the way to go. But let’s be straight up—cheap as chips doesn’t always mean sweet as. Sure, cutting costs on car insurance might save you a few bucks today, but will your policy actually have your back if something goes wrong?

Finding the right or the "best" car insurance in New Zealand isn’t just about price; it’s about getting the right protection that fits your budget and driving needs. Whether you’re looking for comprehensive car insurance, third-party coverage, or an affordable option that doesn’t skimp on quality, it pays to compare car insurance providers in NZ.

So, how do you strike the right balance between cost and proper cover? Let’s break it down.

The current state of car insurance in New Zealand

The cost of car insurance in New Zealand isn’t the same for everyone. Where you live, your age, and your driving history all influence what you’ll pay. According to the Quashed Index, the average cost of comprehensive car insurance in New Zealand is $1,325 as of Q4 2024, but premiums vary widely by region.

Location | Average yearly car insurance cost ($) |

National | $1,325 |

Auckland | $1,600 |

Canterbury | $1,239 |

Wellington | $1,155 |

Source: Quashed. Note: Actual costs will vary depending on the insurer, policy coverage, excess levels, and individual risk factors such as age, location, and driving history.

Why are car insurance premiums higher in Auckland?

Auckland drivers pay the highest car insurance premiums in New Zealand, and the reason comes down to risk. In 2024, NZ Police recorded 85,277 vehicle thefts in Auckland, compared to 8,584 in Wellington. That’s a massive gap, making Auckland cars a far bigger target. But theft isn’t the only issue. Heavy traffic congestion, accident risk, and rising repair costs can all influence premiums.

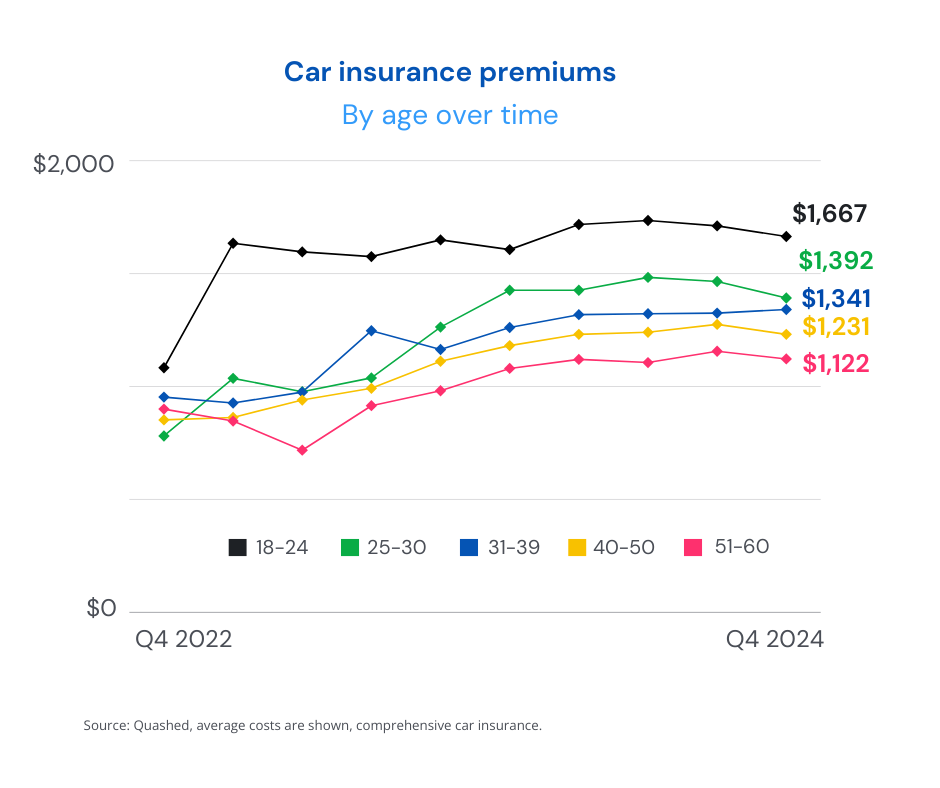

Does age impact car insurance premiums?

Your age is one of the biggest factors in what you’ll pay for car insurance in New Zealand. Here’s how premiums compare across different age groups:

Young drivers (18–24) pay the highest car insurance premiums in New Zealand because of higher accident rates and limited experience.

Drivers in their 30s and 40s generally see car insurance prices stabilise as they build a longer driving record and claims history.

Older drivers (51–60) can secure cheaper car insurance premiums, as they tend to make fewer claims and have a longer history behind the wheel.

While age and location play major roles in determining your insurance premiums, another crucial decision that affects your costs is the type of coverage you choose. Understanding the difference between comprehensive and third-party insurance can help you make an informed choice that balances protection and affordability.

Comprehensive vs. third-party insurance

Car insurance in New Zealand isn’t one-size-fits-all. Let’s break down how comprehensive and third-party coverage stack up.

Comprehensive cover

Comprehensive insurance covers the lot. It protects your car against damage, plus any damage you cause to someone else’s vehicle or property. Right now, the average comprehensive car insurance premium in NZ is $1,346 per year.

Third-party cover

Third-party insurance covers damage you cause to other people’s property but not your own car.

Which one should you choose?

The decision between comprehensive and third-party insurance depends on a few key factors:

Car value: If your car is worth less than $3,000-$4,000, third-party insurance might be the cheaper choice, but it depends on your circumstances.

Your financial situation: Could you afford to replace your car if it’s written off?

Your risk tolerance: Would you be okay covering repair costs yourself?

For many Kiwis, the extra cost of comprehensive cover means better protection—but if you’re driving an older car and comfortable with the risks, third-party insurance could be a way to save some cash.

Insurance premiums aren’t one-size-fits-all. Factors like insurer pricing, your driving history, and location all play a role in what you’ll pay. That’s why it’s worth comparing your options—and Quashed makes it easy to see what’s available and analyse what policy works for your budget.

Tips for finding the right car insurance

Choosing the right car insurance doesn’t have to be complicated. Whether you’re looking for comprehensive coverage, a budget-friendly option, or something tailored to your specific needs, here are some practical tips to help you make a decision.

Compare quotes from multiple providers

Don’t settle for the first quote you receive. Take the time to compare options from different insurers. Online tools like Quashed make it easy to evaluate policies side by side, so you can choose a plan that fits your needs.This is especially important if you’re looking for affordable coverage or want to explore deals that might not be immediately obvious.

Assess your coverage needs

The right insurance plan depends on your unique situation. Consider factors like:

The value of your car

How often you drive and where

Whether you could cover unexpected repair costs

Read the policy details carefully

Before committing, take the time to review the fine print. Make sure you understand what’s included—like liability coverage or agreed value protection—and what’s not. This step is crucial to avoid surprises down the road, especially when it comes to renewing your policy.

Consider special requirements

If you drive an electric vehicle (EV) or a specialty car, such as a Toyota Aqua, your insurance needs might differ from the standard. For instance, EV policies often include coverage for battery replacement or charging equipment. Similarly, high-demand or unique vehicles may require specialised insurance plans. Be sure to explore providers that cater to these specific needs.

Factor in your driving profile

Your age, driving history, and where you live can impact your premiums. For young drivers, finding affordable insurance can be a challenge, but some providers offer tailored plans to help keep costs manageable. Comparing quotes is key to finding a policy that fits your budget without compromising on coverage.

Now that we've covered tips for finding the right car insurance, let's explore how Quashed can simplify this process for Kiwi drivers.

How Quashed simplifies car insurance for Kiwi drivers

Finding the right car insurance can be a real headache—with rising premiums, confusing policies, and too much fine print. That’s where Quashed steps in, making it easy to compare, track, and manage your policies in one place. Here’s how:

Compare multiple insurers in one place: You can quickly see different policy options side by side.

Keep all your policies in one place: Say goodbye to digging through paperwork; everything’s sorted in one simple dashboard.

Understand your cover easily: With side-by-side comparisons help you see what’s covered and what’s not—no jargon, just the facts.

Adjust your cover to suit your needs: You can explore ways to manage your policy, such as adjusting your excess or bundling policies.

Make the right call for your car

45,000+ Kiwis are using Quashed to compare insurance—will you be next?

See your options side by side and choose the coverage that works for you, all in one place.

Sign up now for free and get started on your car insurance comparison today!

Further reading

Want to explore more about car insurance? Check out these helpful blogs:

Car Insurance Guide: A complete guide to car insurance.

Smart Ways to Slash Your Car Insurance: Tips on cutting costs without losing coverage.

What Car Insurance Covers: Key details on what’s included in your policy.

Comparing Insurance Costs for Top Cars: Insurance costs for popular NZ car models.

Why Is Car Insurance So Expensive?: Understand why premiums are rising.

Choosing the Best Car Insurance: Factors to consider when picking a policy.

Sorting Out Your Car Insurance Renewal: Tips to avoid overpaying at renewal.

Car Insurance Quotes Explained: Get accurate quotes with confidence.

Electric Vehicles and Insurance: Do EVs cost more to insure?

Debunking Car Insurance Myths: Common myths that could cost you.

FAQs

Why are car insurance premiums going up so much in New Zealand?

Car insurance costs are climbing, and it’s got Kiwis scratching their heads. Rising repair bills, inflation, and global reinsurance hikes are pushing prices up—whether you’ve claimed or not. But here’s the thing: you don’t have to take it lying down. Quashed lets you compare policies side by side, so you can check out what’s available and make a call that works for you.

What should I watch out for with cheap car insurance?

A bargain policy might seem like a win—until you need to claim. Some budget policies come with sky-high excesses, sneaky exclusions, and limits that could leave you stranded. With Quashed, you can compare the fine print and weigh up different options based on price and cover.

How can I lower my car insurance premium without sacrificing coverage?

Cutting costs without cutting corners is possible. Increasing your excess, bundling policies, and keeping a clean driving record all help. Quashed makes it easy to compare policies and explore ways to manage your premium.

Does age affect my car insurance rates?

Yes, drivers under 25 often face higher premiums because of increased risk. But safe driving and completing a defensive driving course can help lower premiums over time.

What factors influence my car insurance premium?

Several factors influence your premium, such as your age, driving history, vehicle type, location, and the level of coverage you choose. Premiums vary based on insurer pricing models and individual risk factors.

Should I shop around for car insurance when my renewal is due?

Yes, absolutely! Insurance companies sometimes increase premiums during renewals, even if your circumstances haven’t changed. Comparing policies from different providers allows you to see if there’s a better option that suits your needs. For more on how to handle renewals, check out our blog.

Does my driving history really make a big difference?

It sure does. A clean record means lower premiums, while accidents can bump up your costs. By using Quashed, you can compare policies from insurers that may offer better deals for safe drivers.

What should I consider when insuring an electric vehicle?

EVs have unique insurance needs, from battery coverage to charging equipment protection. Quashed lets you compare policies that may include coverage for EV-specific needs, such as battery protection.

How does Quashed compare to other comparison tools?

When comparing car insurance options, Quashed lets you evaluate a range of insurance options side by side, helping you make an informed choice. To learn more about what sets Quashed apart, check out our blog.

This article provides general information only and does not constitute insurance or financial advice. Insurance policies vary between providers, and you should check with your insurer or a licensed adviser for guidance specific to your situation. For full details, refer to Quashed’s terms and conditions.