Feeling the pinch with rising house insurance premiums? Many Kiwi homeowners are watching their costs climb, with premiums increasing over the last couple of years, according to the Quashed Index. Take Wellington, for example—the average cost of house insurance is now over $4,000 a year, which is about the price of a Toyota Vitz on Trade Me. So, what’s behind these rising costs, and more importantly, what can you do to keep your premiums in check? Let’s break it down.

How much does house insurance cost in New Zealand?

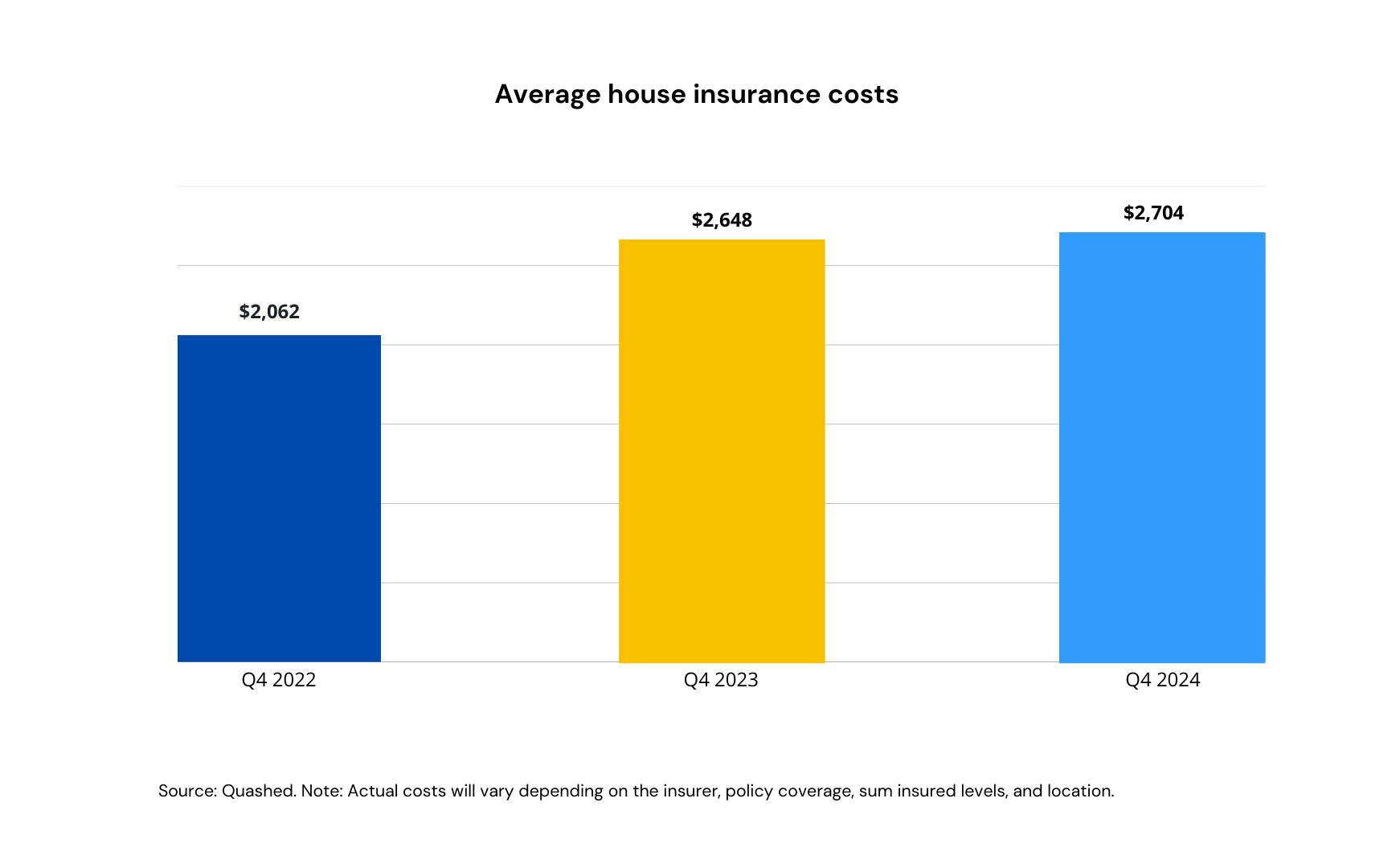

Before we dive into the "why," let’s break down the "how much." As of Q4 2024, the average cost of house insurance in New Zealand is $2,704—a 31% jump from Q4 2022 ($2,062). This sharp increase reflects rising risk factors, insurer pricing adjustments, and the impact of inflation on rebuild costs.

The chart below highlights this increase in average house insurance costs over the past two years.

While national premiums have risen sharply, costs vary significantly by region. Factors such as earthquake risk, extreme weather events, and property values mean some areas face much higher insurance costs than others. Here’s how premiums compare across different regions:

Location | Yearly cost $ |

National | $2,704 |

Auckland | $2,210 |

Canterbury | $2,817 |

Wellington | $4,446 |

Source: Quashed. Note: Actual costs will vary depending on the insurer, policy coverage, sum insured levels, and location.

Wellington stands out as the most expensive region, with an average premium of $4,446 per year, largely due to its high earthquake risk. In contrast, Auckland homeowners typically pay around $2,210, reflecting a mix of property values and general weather-related risks.

These regional differences highlight how location and risk levels directly impacts what you pay. But rising premiums aren’t just about where you live—broader factors like natural disasters, construction costs, and climate change are also driving up costs.

Let’s unpack these drivers and explore how they affect your insurance bill.

Natural disasters and extreme weather events

New Zealand frequently experiences natural disasters like earthquakes, floods, and storms. These worsening events are driving up insurance costs as insurers adjust their prices to manage higher risks.

In 2022, severe weather events resulted in $351 million in insurance claims. This surge in claims has increased costs for insurers, which are then passed on to homeowners. Regions like Wellington and Christchurch are particularly affected due to their higher natural disaster risks.

Living in areas prone to earthquakes or other natural disasters significantly impacts insurance costs. Insurance companies charge higher premiums in these locations to account for the greater likelihood of large claims. Even if you never make a claim, residing in these high-risk areas can still result in higher premiums for your house insurance coverage.

Natural disasters don’t just lead to more claims—they also increase the costs of rebuilding. Rising prices for building materials and labour are adding even more pressure to premiums.

Need more details on house insurance? Explore our Further Reading section for more.

Rising costs of construction and repairs

The impact of natural disasters extends beyond claims—rising construction and labour costs are making repairs and rebuilding even more expensive.

Another factor driving premiums up is the increasing cost of building materials and labour. If home renovations or repairs feel pricier than ever, you’re not alone. Rising construction and labour costs mean it’s more expensive for insurers to cover repairs or rebuilding, which directly impacts your premium.

Why this matters: Insurers calculate your premium based on the “sum insured,” which is the estimated cost to rebuild your home. As rebuild costs go up, so does your premium.

Quick tip: Using tools like the Cordell Sum Sure Calculator can help you keep your sum insured accurate.

Reinsurance costs

With rebuilding becoming more expensive, insurers also face increasing risks. Reinsurance, which helps insurers manage these risks, plays a critical role in shaping premiums.

Reinsurance may sound complex, but it’s essentially insurance for insurance companies. It protects insurers from major events, like earthquakes, that impact many homes. As natural disasters become more frequent globally, reinsurance costs have risen, and consumers are feeling the effects.

If you live in a high-risk area, part of your premium likely reflects these rising reinsurance costs. As a result, homeowners in New Zealand are seeing changes in their insurance rates to cover these added expenses.

Looking for more house insurance tips? Head to our Further Reading section for more.

The shift to risk-based pricing

Reinsurance spreads the financial burden of large-scale disasters, but risk-based pricing focuses on tailoring premiums to individual properties.

You might wonder, “What is risk-based pricing?” It’s a method insurance companies use to set prices based on the specific risks of each property.

Instead of applying the same rate to every house in the same area, insurers adjust prices according to the risks of each home. This means your insurance premium could differ significantly from your neighbour’s—even if you live on the same street.

If you own an older home with outdated wiring or live in an area with higher crime rates, your insurance costs might be higher. Even within the same neighbourhood, premiums can vary—newer homes are often cheaper to insure than older ones.

The impact of climate change

Risk-based pricing is particularly important as climate change continues to amplify risks. Insurers are rethinking their models to deal with the growing number of extreme weather events.

Climate change is a key reason house insurance prices are on the rise. Floods, strong storms, and other extreme weather events are happening more often—and with more intensity—making it riskier to insure homes in certain areas.

For example, if your property is near a river or along the coast, you might notice higher premiums to cover increased flood risks. This is just one way insurers are responding to the challenges climate change is throwing their way.

Want to learn more about house insurance? Visit our Further Reading section for top tips and insights tailored for Kiwis.

What can you do to manage rising costs?

While these factors are driving up premiums, there are steps you can take to lower your costs and ensure you’re protected. Let’s explore how to manage your house insurance effectively.

Review your coverage regularly: Make sure it reflects accurate rebuilding costs to avoid over- or under-insuring your home.

Consider increasing your excess: A higher excess can help lower your premium, but be sure it’s an amount you can comfortably afford if you need to make a claim.

Shop around and compare policies: Take the time to compare different providers to find the best deal for your needs.

Review your cover regularly

Make sure your sum insured matches the current cost to rebuild your home. Overestimating your coverage can result in higher premiums, while underestimating it may leave you underinsured—putting your finances at risk if disaster strikes. Tools like the Cordell Sum Sure Calculator makes this process simple and stress-free.

Here’s an example to show why regular reviews matter:

A house with a sum insured of $1,000,000, but a more realistic valuation of $750,000, highlights the importance of reviewing your cover regularly.

Sum insured ($) | Average yearly house insurance costs ($) |

$1,000,000 (overvalued) | $2,665 |

$750,000 (actual value) | $2,039 |

Source: Quashed. Note: Actual costs will vary depending on the insurer, policy coverage, sum insured levels, and location.

In this case, adjusting your sum insured to reflect the actual rebuilding cost could save you $626 every year. By regularly reviewing and updating your cover, you can ensure you have the right protection without overpaying for unnecessary premiums.

Looking for more house insurance tips? Head to our Further Reading section for expert insights and tips.

Consider increasing your excess

Increasing your insurance excess means paying more out-of-pocket when you claim, but it can significantly lower your annual premium. In some cases, a higher excess can reduce your costs by up to 20%, making it a great option for those comfortable paying more upfront to save money over time.

Example: Adjusting your excess

Consider the same home in Auckland with a sum insured of $750,000. Here's how different excess amounts can affect your annual premium:

Excess ($) | Average yearly house insurance costs ($) | Savings compared to $500 Excess |

$500 | $2,039 | - |

$1,000 | $1,877 | $162 |

$2,000 | $1,725 | $314 |

Source: Quashed. Note: Actual costs will vary depending on the insurer, policy coverage, sum insured levels, and location.

By increasing your excess from $500 to $1,000, you could save $162 each year. If you raise it to $2,000, your savings grow to $314 annually. Before adjusting your excess, think about your ability to pay the higher amount if you need to make a claim. It’s important to find a balance between the savings you’ll enjoy now and the potential out-of-pocket costs you may face later.

Shop around and compare policies

Sorting out house insurance doesn’t have to be a hassle.

With Quashed, you can compare real-time quotes from multiple insurers, side by side, all in one place—no more juggling different websites.

Adjust your cover easily, explore different sum insured or excess options, and see how they may impact your premium—all with up-to-date information at your fingertips. Plus, get clear policy summaries and full wording documents to help you make informed decisions with confidence.

So why does comparing matter? Some policies may have lower premiums but come with higher excesses or exclusions. Others might offer extras like higher liability cover, inflation protection, or optional add-ons. Comparing lets you weigh up the options and find the right balance between cost and cover.

Protect your home, protect your budget

Finding the right house insurance that suits you doesn’t have to take up too much time.

With Quashed, you can compare up-to-date quotes without the hassle of endless Googling.

Further reading

Explore these helpful guides for more on house insurance:

House Insurance Guide: A complete overview of house insurance.

8 Budget Hacks for House Insurance:Practical ways to cut costs.

Key Considerations for House Insurance: What to think about before buying.

Top House Insurance Questions Answered: Common questions, straight answers.

Rethinking Insurance for First-Time Buyers: Helpful tips for first-time buyers.

House Insurance Premiums & Climate Change: Learn about climate change and house insurance.

Home Upgrades That Impact Insurance Premiums: Upgrades that could lower costs

Average Costs of Insurance in New Zealand: Insights into the cost of house, contents and car insurance

FAQs

How do I determine the right sum insured for my home?

Your sum insured should reflect the full rebuild cost of your home, not its market value. This includes:

Construction materials and labour costs.

Demolition and site clearance.

Compliance and consent costs.

Professional fees (e.g., architects, engineers). Using a tool like the Cordell Sum Sure Calculator gives you an estimate, but if your home has unique features, consider a professional valuation.

How often should I update my sum insured?

At least once a year. Construction costs can increase, and if you’ve renovated or made improvements, your sum insured may be too low. Many insurers allow adjustments mid-policy if needed.

What’s the difference between market value and rebuild cost?

Market value = What your home would sell for, including land value.

Rebuild cost = The total cost to reconstruct your home from scratch, excluding land value. Insurance covers the rebuild cost, so it's critical to get this right.

Can I reduce my home insurance costs?

Yes. Here’s how:

Increase your excess – Higher excess = lower premiums

Bundle policies – Insurers often give discounts if you combine house, contents, and car insurance

Improve security – Smoke alarms, burglar alarms, and modern wiring can reduce risk

Compare providers – Shopping around can save you hundreds

What happens if I’m underinsured?

If your sum insured is too low, you may not receive enough to fully rebuild your home in the event of a total loss. This could leave you out of pocket for tens or even hundreds of thousands of dollars. Solution: Use a rebuild calculator and update your sum insured regularly.

Can I change insurers mid-policy?

Yes, but check for cancellation fees. Some insurers refund unused premiums, while others charge a small admin fee. Always compare the savings before switching.

What should I do if my insurance claim is denied?

Read the insurer’s reason—is it an exclusion or an error?

Provide evidence—photos, receipts, and expert reports strengthen your case.

Ask for a review—insurers often reconsider claims if new evidence is provided.

Complain to FSCL or the Insurance Ombudsman if you believe the denial was unfair.

This article provides general information only and does not constitute insurance or financial advice. Insurance policies vary between providers, and you should check with your insurer or a licensed adviser for guidance specific to your situation. For full details, refer to Quashed’s terms and conditions.