If your latest car insurance renewal has you wondering, 'Why am I paying so much?'—you’re not alone. Car insurance costs keep climbing, and it's getting harder to keep up.

But before you throw your hands up in frustration, let’s talk about why this is happening and what you can actually do about it. With Quashed, you can compare policies, adjust coverage, and explore available options that may suit your budget.

How much does car insurance cost in New Zealand?

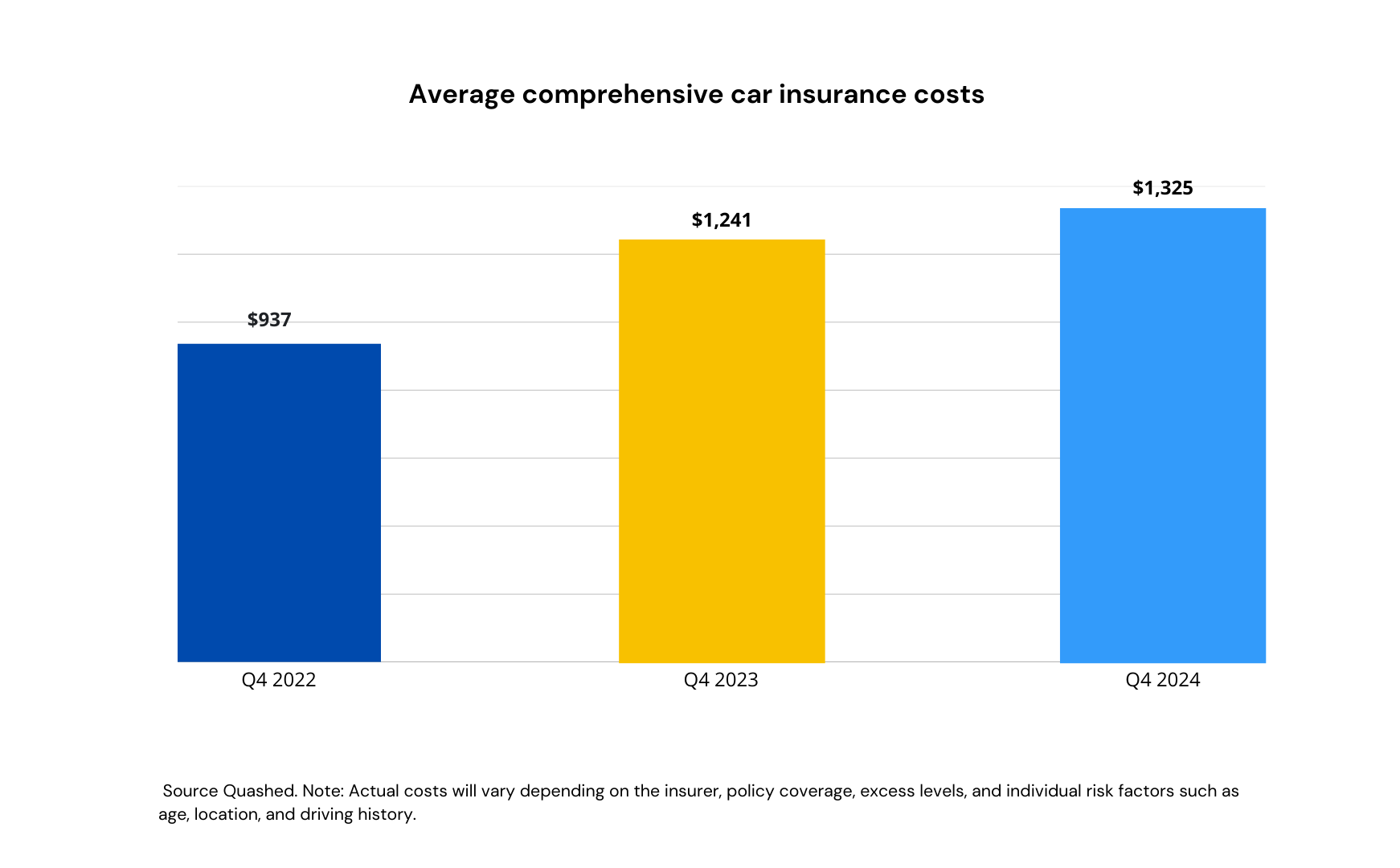

Car insurance premiums in New Zealand have soared over the past two years. If you’ve noticed your renewal costs creeping up, you’re not alone. Data from Quashed shows that the average comprehensive car insurance premium has surged from $937 in Q4 2022 to $1,325 in Q4 2024—a 41% jump. The chart below illustrates just how steep the increase has been.

As you can see in the graph above, insurance costs have risen significantly in just two years. But how much you pay depends on more than just overall market trends—your age plays a huge role too.

Car insurance costs by age

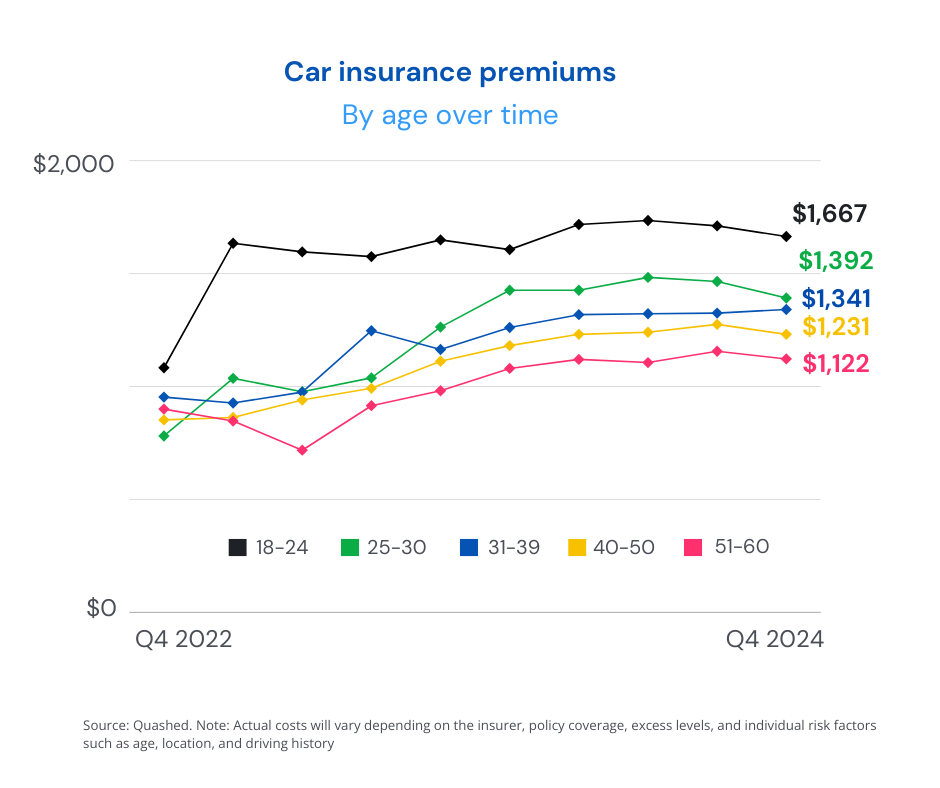

Your age has a huge impact on how much you pay for car insurance. Younger drivers face the highest premiums, while costs tend to stabilise with age.

18-24-year-olds pay the most, with an average premium of $1,667 in Q4 2024.

Drivers aged 25-30 pay around $1,392, still much higher than the overall average.

Premiums gradually decrease for older drivers, with those in their 40s and 50s paying closer to $1,231 and $1,122, respectively.

The graph above clearly shows that younger drivers pay significantly more for car insurance, largely due to higher accident risk and lack of experience. But age isn’t the only factor pushing up prices. While age plays a big role in pricing, it's not the only factor pushing up costs. Let’s look at what else is driving premiums higher in New Zealand.

Why are car insurance costs increasing in New Zealand?

You might feel like your premiums are just a random number, but there’s a lot that goes into calculating them. Here’s why your car insurance might be getting more expensive:

Repair cost increases: Modern cars in New Zealand come with advanced technology, making repairs more expensive. As a result, insurers have raised car insurance costs to cover these rising expenses.

Extreme weather events: Floods, storms, and other disasters—like Cyclone Gabrielle—are becoming more frequent, driving up car insurance premiums across New Zealand.

Rising vehicle values: New and used car prices have surged, meaning higher car insurance premiums for owners.

High claim rates: More accidents mean insurers face higher payouts, leading to increased car insurance prices in high-risk areas like Auckland.

Inflation pressures: Inflation is pushing up repair and labour costs, directly impacting car insurance costs.

Location: Where you live affects your car insurance premium. Auckland residents, for example, face higher costs due to congestion and frequent weather events.

Electric vehicles (EVs): EV owners in NZ may see higher insurance premiums due to costly advanced parts and repairs.

Pro tip: Use Quashed to compare car insurance and find smarter ways to save.

How are your car insurance premiums calculated in New Zealand?

Curious about how your car insurance premium is calculated in New Zealand? Insurers consider several key factors that influence your car insurance costs:

Your car: High-value or newer models with advanced technology often lead to higher car insurance premiums.

Your driving history: A clean record can help lower your car insurance costs, while past claims or accidents—regardless of fault—may increase your premiums.

Your age: Younger drivers, especially under 25, tend to pay more due to higher accident risks. For example, 18–24-year-olds usually face higher premiums and excess rates.

Your mileage: Driving more increases the likelihood of claims, which can push up car insurance prices, while low-mileage drivers may be eligible for savings.

Additional cover: Optional extras like rental car cover and roadside assistance provide convenience but can add to your overall insurance costs.

Understanding these factors can help you make smarter choices to manage your car insurance premium in New Zealand.

With Quashed, comparing car insurance policies is easy. Adjust key settings—like your excess or cover type—and see how they affect your costs

Looking to save on car insurance? Here's how

Car insurance can feel overwhelming, but Quashed simplifies it.

Instead of browsing multiple insurer websites, you can compare car insurance prices and features side by side—all in real time. Here’s how Quashed helps you take control of your car insurance costs:

Sum insured: Adjust your coverage amount with Quashed and see how it affects your premium. Lowering it can reduce costs, but make sure you have enough cover for your needs.

Excess: Want to lower your monthly premiums? Quashed helps you explore how increasing your excess—the amount you’d pay when making a claim—can lead to savings.

Type of cover: Whether you’re after comprehensive, third-party, or third-party, fire, and theft cover, Quashed helps you compare options and understand how each affects your premium

With Quashed, comparing car insurance quotes across New Zealand is hassle-free. See how adjusting settings—like your excess—can help you find the right cover at the right price.

Example: how adjusting your excess can lower your car insurance costs

Small adjustments can make a big difference to your car insurance premium. To show you how, here’s an example:

Vehicle: Ford Ranger

Sum insured: $40,000

Location:Auckland

Driver profile: Female, aged 40

Insurance type: Comprehensive car insurance

Payments frequency: Yearly

Excess ($) | Average car insurance cost ($) | Saving ($) |

|---|---|---|

$400 | $1,813 | |

$750 | $1,612 | $201 |

$1,500 | $1,530 | $283 |

Source: Quashed. Note: Actual costs will vary depending on the insurer, policy coverage, excess levels, and individual risk factors such as age, location, and driving history.

In this example by increasing the excess from $400 to $1,000, there is a saving of $283 per year. That’s a significant saving for just one small adjustment.

Try this for yourself: With Quashed, you can adjust settings like your excess in seconds and see the impact on your premium. Whether you want to save upfront or reduce long-term costs, Quashed puts you in control.

45,000+ Kiwis use Quashed to compare insurance

Car insurance costs keep climbing, but you’re not out of options.

Small tweaks—like adjusting your excess or reviewing your coverage—can make a real difference.

Join thousands already comparing with Quashed and see what’s possible.

Further reading

Want to understand more about car insurance and how to manage costs? Check out these helpful articles:

Choosing the Right Car Insurance: What to consider when picking the right policy.

Smart Ways to Slash Your Car Insurance: Tips to lower your premiums without compromising cover.

Cheapest vs Best Car Insurance in NZ: Balancing affordability and quality coverage.

Comparing Insurance Costs for Top Cars: How different cars affect your premiums.

Car Insurance Quotes: How to compare quotes and find the best deal.

Debunking Car Insurance Myths: Separating fact from fiction when it comes to cover.

FAQs

Why are car insurance premiums rising in New Zealand?

Car insurance premiums are increasing due to inflation, higher repair costs for modern vehicles, more extreme weather events, and rising car values. Insurers also adjust premiums based on claim rates and location risks.

Factors driving up costs include:

Inflation affecting vehicle parts and repair costs

More expensive modern car technology

Rising claim rates across the country

Higher reinsurance costs due to global insurance trends

Location-based risk factors, such as theft and accident rates

How does my location affect my car insurance premium?

Your location impacts your car insurance premium because insurers assess regional risks such as accident rates, theft frequency, and traffic congestion.

Higher premiums typically apply to areas with:

High traffic density and congestion

Increased accident rates

More vehicle thefts or vandalism

Expensive vehicle repair costs in the region

Comparing insurers can help you find a competitive rate for your area.

Are certain car models more expensive to insure in New Zealand?

Yes, some cars are more expensive to insure due to higher theft risk, costly repairs, or advanced technology.

Vehicles that typically have higher premiums include:

Cars frequently targeted by thieves

Models with expensive parts or specialised repairs

Vehicles without modern security features like immobilisers

If you’re looking to lower insurance costs, choosing a model with strong safety features and lower theft risk can help.

Should I shop around when my car insurance policy is up for renewal?

Yes, shopping around at renewal time can help you avoid premium increases and find better value.

Why you should compare quotes at renewal:

Insurers may increase premiums even if nothing has changed

New customer discounts may be available elsewhere

Coverage and pricing vary between insurers

Comparing your current policy against new quotes ensures you're not overpaying.

How can Quashed help me save on car insurance?

Quashed makes it easy to compare car insurance by showing real-time quotes from multiple insurers.

With Quashed, you can:

Compare quotes side by side

Adjust your excess, coverage type, and sum insured

See how changes impact your premium

This helps you find a competitive option that suits your budget.

What factors contribute to the rising cost of car insurance?

Several factors are driving up car insurance costs:

Inflation – Higher repair and replacement costs

Advanced car technology – More expensive repairs

Rising claim rates – More claims = higher costs for all drivers

Natural disasters – Cyclones and extreme weather push up premiums

Reinsurance costs – Global insurance trends impact local pricing

Understanding these factors can help you make informed decisions about your coverage.

How can I reduce my car insurance premium?

To lower your car insurance costs, you can:

Increase your excess – A higher excess means a lower premium

Review your coverage – Make sure you're not over-insured

Install security features – Immobilisers and alarms can reduce risk

Compare quotes regularly – Prices vary between insurers

Bundle policies – Some insurers offer discounts for multiple policies

Taking these steps can help you save while keeping the coverage you need.

This article provides general information only and does not constitute insurance or financial advice. Insurance policies vary between providers, and you should check with your insurer or a licensed adviser for guidance specific to your situation. For full details, refer to Quashed’s terms and conditions.