Kiwi homeowners are feeling the sting as house insurance premiums keep climbing. If your wallet's been hit with rising insurance costs, you're definitely not alone. In this guide, we'll dive into why these prices are on the up, how they differ from one region to the next, and, most importantly, what you can do to keep your costs in check. Let’s break it down!

House insurance costs across New Zealand

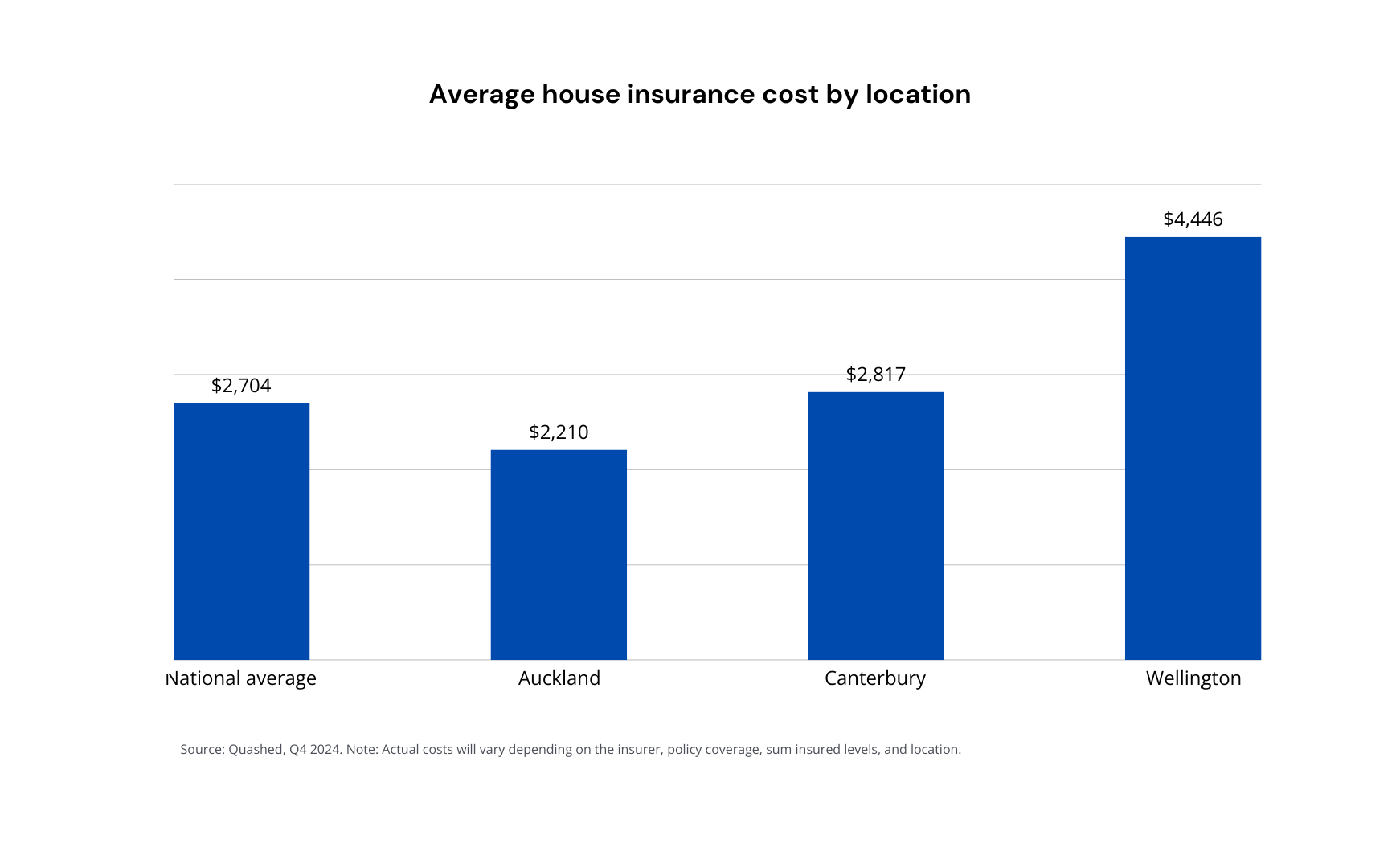

The average cost of house insurance in New Zealand is $2,704 per year as of Q4 2024. This marks a 2% increase from Q4 2023 and a 31% rise since Q4 2022, reflecting ongoing cost pressures from inflation, rising claims, and global reinsurance pricing.

House insurance premium trends over time (Q4 2024)

Location | Average House Insurance Cost $ | Year-on-Year % Change |

Q4 2022 | $2,062 | — |

Q4 2023 | $2,648 | +28% |

Q4 2024 | $2,704 | +2% |

Source: Quashed, Q4 2024. Note: Actual costs will vary depending on the insurer, policy coverage, sum insured levels, and location.

House Insurance premiums by region (Q4 2024)

House insurance costs vary significantly by region, with Wellington homeowners paying the most due to earthquake risks, while Auckland residents enjoy the lowest premiums.

Key takeaways from the latest data:

Wellington: the most expensive region for house insurance Wellington remains the most expensive city for house insurance in NZ, with an average premium of $4,446 per year—a staggering $1,742 above the national average. This is due to high earthquake risk and global reinsurance models assessing Wellington as a high-risk zone.

Canterbury: slightly above national average, reflecting ongoing seismic risk Canterbury's average premium of $2,817 per year is $113 higher than the national average. While pricing has stabilised compared to post-earthquake highs, insurers still factor in seismic risk assessments when setting rates.

Auckland: the lowest house insurance costs Auckland homeowners pay an average of $2,210 per year, nearly $500 below the national average. The city’s lower earthquake risk profile contributes to more affordable premiums compared to other major centres.

Why are house insurance costs increasing?

House insurance premiums in New Zealand have been steadily increasing, and climate change is one key driver behind this trend. Frequent and severe weather events like flooding and storms, coupled with region-specific risks such as Wellington’s earthquake vulnerability, are putting financial pressure on insurers. These factors have led to higher premiums for homeowners across the country.

For a detailed analysis of these trends and what they mean for Kiwi homeowners, check out our blog on Why House Insurance Premiums Are Increasing.

How to lower house insurance costs

Looking to reduce your house insurance premiums? Two often-overlooked settings could save you significant money on your policy: your excess and sum insured amounts.

Increase your excess

Adjusting your excess can reduce your house insurance costs significantly. For instance, moving from a $1,000 to a $2,000 excess could lead to savings, especially when combined with other adjustments.

Review your sum insured

Setting the right sum insured helps ensure you're not paying too much in premiums while still having enough coverage if you need to rebuild.

If you're considering buying a house, check out our blog post, Rethinking Insurance for First-Time Home Buyers, for insights to help you understand your options and avoid common mistakes. For more money-saving strategies, explore our guide 8 Budget Hacks for House Insurance.

How Quashed makes insurance shopping easier

We get it—finding the right house insurance can feel overwhelming. That’s why Quashed makes it simple, transparent, and tailored for you. Here’s what sets us apart:

Real-time information: Forget outdated comparisons. Quashed gives you up-to-the-minute quotes and policy details from insurers.

Compare policies side-by-side: See what’s covered (and what’s not) across multiple providers. Whether it’s temporary accommodation, glass cover, or natural disaster protection, we make it easy to compare all the details that matter.

Customised to your needs: Plug in your sum insured and preferred excess, and we’ll do the hard work for you. Quashed tailors the results to match your property and budget, whether you’re after premium protection or just the basics.

Save time, money, and stress: No more juggling tabs or deciphering confusing fine print. We simplify everything, so you can choose the best policy in minutes and feel confident about your decision.

With Quashed, you’re not just comparing policies—you’re taking control of your insurance journey.

Protect your home, control your insurance costs

House insurance in New Zealand is getting more expensive, but smart choices can keep your premiums in check.

Quashed makes house insurance simple: side-by-side comparisons, tailored options, and potential savings—all with a distinctly Kiwi approach that's fast and stress-free.

Further reading

Explore these articles to better understand house insurance costs, coverage, and ways to save:

Why Are House Insurance Premiums Increasing?: Understand why premiums are rising.

8 Budget Hacks for House Insurance: Practical tips to save on premiums.

How to Compare House Insurance Quotes: A step-by-step guide to comparing quotes.

Key Considerations with House Insurance: Important things every homeowner should know.

Top House Insurance Questions Answered: Common questions and straight answers.

Home Upgrades & Insurance Premium Impact: How home improvements affect your insurance.

Rising House Insurance Premiums & Climate Change: The effect of climate change on insurance premiums.

Rethinking Insurance for First-Time Home Buyers: Key considerations for first-time buyers.

House Insurance for Older Homes: Insurance tips for high-risk properties.

FAQs

House insurance costs & increases

How much have house insurance premiums increased by in NZ?

According to Quashed’s latest data from Q4 2024, the average house insurance premium in New Zealand is now $2,704 per year, reflecting a 2.1% rise from 2023 and a 31% increase over two years. Premium increases are driven by inflation, rising claims from natural disasters, and global reinsurance market trends.

Why are house insurance premiums increasing so fast?

Premiums are rising due to higher rebuild costs, climate change, and natural disaster-related claims. Insurers adjust rates to reflect these risks and the growing cost of global reinsurance.

Which region has the highest house insurance costs in New Zealand?

Wellington has the highest house insurance premiums, averaging $4,446 per year in 2024. This is due to:

High earthquake risk – Seismic activity increases claim likelihood.

Reinsurance pricing models – Global insurers classify Wellington as high-risk, raising costs.

Increased building costs – Higher material and labour costs make rebuilding more expensive.

Factors affecting premiums

How does climate change affect house insurance premiums?

Climate change is increasing the frequency and severity of extreme weather events, leading to higher insurance costs. Insurers adjust premiums based on:

Rising claims from floods, storms, and cyclones

Higher risks in coastal and flood-prone areas

Increased costs of rebuilding after extreme weather events.

Why has my house insurance premium gone up even though I haven’t made a claim?

Insurance premiums are based on market-wide trends, not just individual claims. Your premium may have increased due to:

Inflation – Higher repair and rebuilding costs.

Increased claims across NZ– More storm, flood, and earthquake claims impact all policyholders.

Reinsurance costs – Insurers pass on higher global insurance expenses.

What is reinsurance, and how does it impact house insurance premiums?

Reinsurance is insurance for insurers—it helps them cover the cost of large-scale disasters. When major global events occur, reinsurers raise their prices, which leads to:

Higher costs for NZ insurers

Premium increases for homeowners to cover reinsurance expenses.

More expensive policies in high-risk regions like Wellington.

Reducing your house insurance premium

How can I lower my house insurance premiums in New Zealand?

You may be able to reduce your premiums by:

Increasing your excess – A higher excess can lower your premium.

Reviewing your sum insured – Ensure it matches actual rebuild costs to avoid overpaying.

Paying annually instead of monthly – Some insurers charge extra fees for monthly payments.

Bundling policies – Combining house and contents insurance may unlock discounts.

Improving home security – Fire alarms, security systems, and earthquake strengthening may help reduce costs.

Comparing insurers regularly – Prices vary, so shopping around can help you find savings.

Are insurance companies making profits from premium increases?

While some insurers have reported strong profits, premium adjustments are primarily influenced by rising claims costs and global reinsurance pricing pressures. Insurers use risk models and market data to determine rates.

Choosing & comparing policies

How can I compare house insurance policies in NZ?

Quashed makes it easy to compare house insurance policies side by side in real time. You can:

Adjust coverage based on your needs.

See premium impacts when making policy changes.

Find a policy that fits your budget—all in one place.

Do I need to review my sum insured regularly?

Yes, reviewing your sum insured annually ensures it accurately reflects current rebuild costs. If it’s not updated, you risk:

Over-insurance– Paying too much for unnecessary coverage.

Under-insurance – Not being fully covered when you need it most.

Can increasing my policy excess help lower my house insurance premium?

Yes. Increasing your excess—the amount paid out-of-pocket when making a claim—can lower your premium. However, make sure to:

Choose an excess amount that’s affordable in case you need to make a claim.

Balance savings with financial security—a high excess lowers premiums but increases costs when claiming.

This article provides general information only and does not constitute insurance or financial advice. Insurance policies vary between providers, and you should check with your insurer or a licensed adviser for guidance specific to your situation. For full details, refer to Quashed’s terms and conditions.